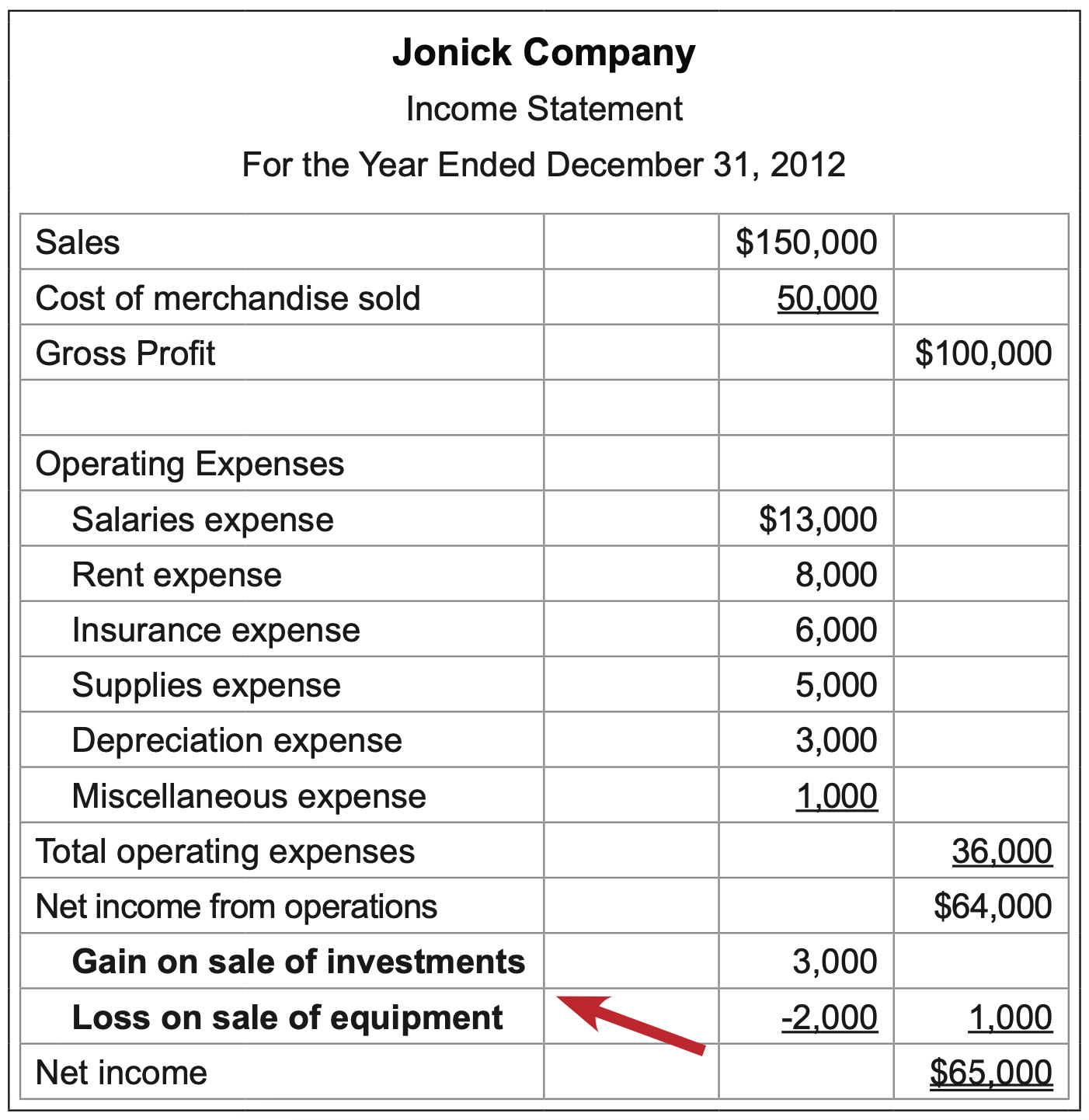

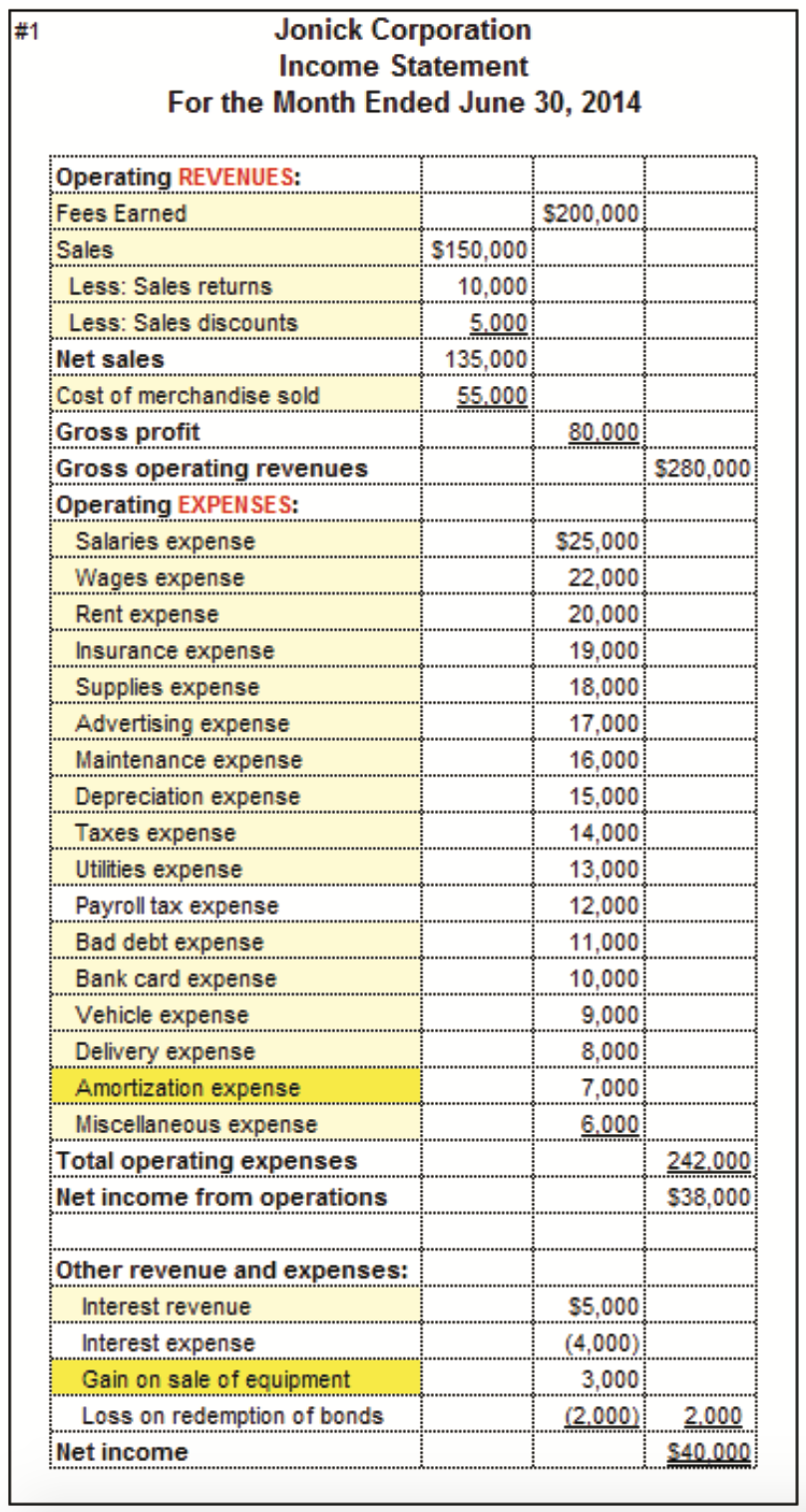

Gains and losses are reported on the income statement. However, since they are not transactions that normally occur in the day-to-day operations of a business, they are listed below a new line entitled “Net income from operations.” Net income from operations summarizes revenue and expenses from operational transactions. Gains are added to that amount and losses are deducted to arrive at the final net Income result. Notice how gains and losses are presented on the income statement:

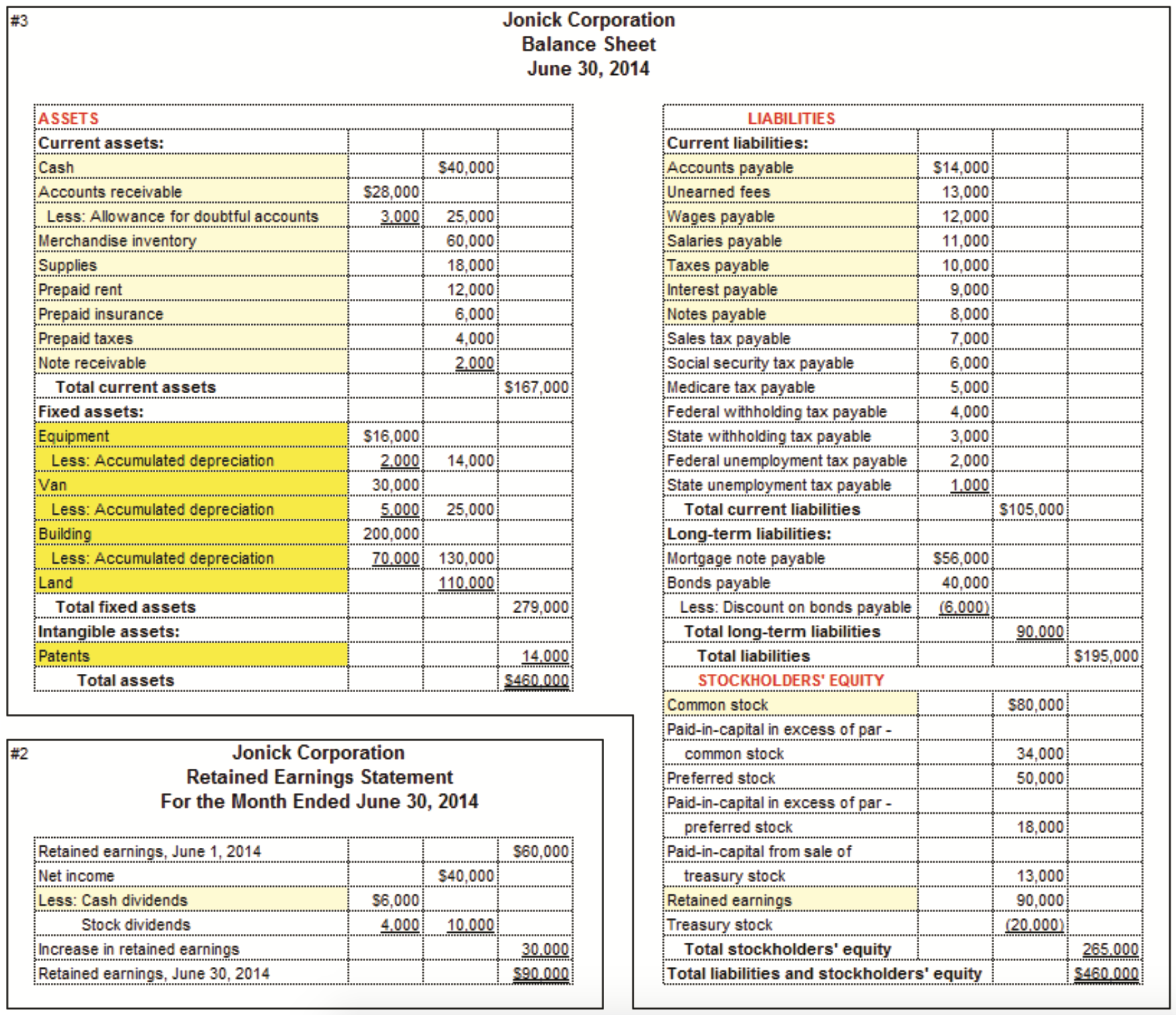

Other longer-term assets that a business may possess and use for its operations are not physical items. These are therefore called intangible assets and may include patents, copyrights, internet domain names, franchises, trademarks, and goodwill. Patents and copyrights, for example, represent a business’s exclusive right to use or do something that other businesses cannot, at least not without permission. Intangible assets that have finite, or defined useful lives are expensed off over time, similar to fixed assets. This expense for fixed assets is called depreciation; however, for intangible assets it is called amortization. There is no separate contra asset account used when amortizing an intangible asset. Instead, the value of the asset is credited and declines over time. The maximum legal life of a patent is 20 years, but a company can assign a useful period of less than that based on its planned usage. Copyrights and franchises also have specific useful lives. Therefore, these assets may be amortized. The following annual adjusting entry is an example of the amortization of a patent that cost $12,000 to purchase and that has a useful life of 12 years.

| Date | Account | Debit | Credit |

| 12/31 | Amortization Expense | 1,000 | ▲ Amortization Expense is an expense account that is increasing. |

| Patents | 1,000 | ▼ Patents is an asset account that is decreasing. |

Internet domain names and trade names are considered to have infinite useful lives since they are continuously renewable. Only if a company assigns a specific usage period to either of these would the intangible asset be amortized. Goodwill is the most common intangible asset with an indefinite useful life. Goodwill results only when a business buys another company and pays more than the fair value of all of the assets and liabilities it acquires. No useful life can reasonably be determined; therefore, goodwill is not amortized. The balances of both fixed and intangible assets are presented in the assets section of the balance sheet at the end of each accounting period. When a company has a significant number of assets, they are typically presented in categories for clearer presentation. A financial statement that organizes its asset (and liability) accounts into categories is called a classified balance sheet. The partial classified balance sheet that follows shows the assets section only. Note that there are four sections. Current assets itemizes relatively liquid assets that will be converted to cash or used within one year. Long-term assets presents financial assets that are intended to be held for more than one year. These will be discussed in a later section of this document. Property, plant and equipment lists physical assets with a useful life greater than one year, as well as the associated Accumulated Depreciation account for each fixed asset that is depreciated. The property, plant and equipment category reports the original cost of each fixed asset, the total amount of that cost that has been expensed off over time to date, and the resulting book value. Intangible assets are then presented. The total of asset for each category appears in the far right column of the classified balance sheet, and the sum of these totals appears as total assets.

| Jonick Company Balance Sheet June 30, 2018 | |||

| Assets | |||

| Current assets: | |||

| Cash | $40,000 | ||

| Accounts receivable | $28,000 | ||

| Less: Allowance for doubtful accounts | 3,000 | 25,000 | |

| Merchandise Inventory | 60,000 | ||

| Supplies | 18,000 | ||

| Prepaid Rent | 12,000 | ||

| Total current assets | $155,000 | ||

| Long-term assets: | |||

| Investment in equity securities | 18,000 | ||

| Property, plant and equipment: | |||

| Equipment | $16,000 | ||

| Less: accumulated depreciation | 2,000 | $14,000 | |

| Building | 200,000 | ||

| Less: accumulated depreciation | 70,000 | 130,000 | |

| Land | 110,000 | ||

| Total property, plant and equipment | 254,000 | ||

| Intangible assets: | |||

| Patents | 13,000 | ||

| Total assets | $440,000 | ||

The following Accounts Summary Table summarizes the accounts relevant to property, plant and equipment and intangible assets.

| ACCOUNT TYPE | ACCOUNTS | TO INCREASE | TO DECREASE | NORMAL BALANCE | FINANCIAL STATEMENT | CLOSE OUT? |

| Asset | Building Land Truck Equipment Patent Copyright Trademark Goodwill | debit | credit | debit | Balance Sheet | NO |

| Contra Asset | Accumulated Depreciation | credit | debit | credit | Balance Sheet | NO |

| Liability | Note Payable | credit | debit | credit | Balance Sheet | NO |

| Revenue or Gain | Gain on Disposal of Fixed Asset | credit | debit | credit | Income Statement | YES |

| Expense or Loss | Depreciation Expense Loss on Disposal of Fixed Asset | debit | credit | debit | Income Statement | YES |

| Topics – Fixed assets | Fact | Journal Entry | Calculate Amount | Format |

| Concept of fixed assets and depreciation | x | |||

| Calculate the cost basis of a fixed asset | x | |||

| Calculate full-year depreciation using straight-line method | x | |||

| Calculate partial-year depreciation using straight-line method | x | |||

| Calculate full-year depreciation using units of production method | x | |||

| Calculate partial-year depreciation using units of production method | x | |||

| Calculate full-year depreciation using declining balance method | x | |||

| Calculate partial-year depreciation using declining balance method | x | |||

| Calculate book value | ||||

| Journalize disposal of a fully-depreciated fixed asset | x | x | ||

| Journalize disposal of a partially-depreciated fixed asset at a loss | x | x | ||

| Journalize sale of a fixed asset for its book value | x | x | ||

| Journalize sale of a fixed asset at a loss | x | x | ||

| Journalize sale of a fixed asset at a gain | x | x | ||

| Journalize exchange of a fixed asset for its book value | x | x | ||

| Journalize exchange of fixed asset at a loss | x | x | ||

| Journalize exchange of a fixed asset at a gain | x | x | ||

| Journalize amortization of an intangible asset | x | x | ||

| Financial statements | x | x | ||

| Journalize closing entries | x | |||

| Post closing entries to ledgers | x | |||

| Journal entry for dividends | x | |||

| Total stockholders’ equity | x | |||

| Accounting equation | x | x | ||

| Changes in stockholders’ equity | x | |||

| Retained earnings statement | x | x | ||

| Balance sheet | x | x | ||

| Financial statements connected | x | x |

The accounts that are highlighted in bright yellow are the new accounts you just learned. Those in highlighted in light yellow are the ones you learned previously.

This page titled 4.8: Gains and losses on the income statement is shared under a CC BY-SA 4.0 license and was authored, remixed, and/or curated by Christine Jonick (GALILEO Open Learning Materials) via source content that was edited to the style and standards of the LibreTexts platform.